A Discount on Bonds Payable Is Best Described as Solved

The discount on a bond payable becomes. January 1 2020-Issuance of bonds.

Amortizing Bond Discount Using The Effective Interest Rate Method Accountingcoach

130A discount on bonds payable is best described as.

. July 1 2020-Interest. The bonds current yield is greater than 9. The effective interest rate is multiplied times the bonds book value at the start of the accounting period to arrive at each periods interest expense.

The discount on bonds payable or premium on bonds payable is shown on the balance sheet as an adjustment to bonds payable to arrive at the carrying value of the bonds. 140Refer to the information above. NOT treated as outright loss but is amortized throughout the life of the bond.

Carrying Value of Bonds. The carrying value of a bond is not equal to the bond payable amount unless the bond was issued at par. Bonds payable of 61800000.

Cheryl Inc issued 100000 8 5-year bonds. Has a credit balance. A reduction of an expense.

Solved by verified expert 1 Unamortized discount is 37810. Indicate the appropriate addition or subtraction to bonds payable. On April 1 2021 1200000 of these bonds were converted into 500 no par common shares.

A credit to Bonds Payable of 970000. Assume a bond is sold in the market for USD 80. Cheryl received 10113680 for the bonds.

An element of future interest expense. 75 bonds payable due December 31 2029. A discount Bond is defined as a bond that is issued for less than its face value at the time of issuance.

The difference between the amount received and the. A reduction in interest expense the year the bonds mature. Credit to Cash of 33000.

It employs 15 people who work 8-hour days. Accounting 1 Year Ago 344 Views. Definition of Discount on Bonds Payable.

The Cash paid out for bond redemption is 2100000 x 105 2205000 which is credited as cash decreases. Tregos entry at June 30 2016 to record the first. Carrying Value Bonds Payable.

Advertisement Survey Did this page answer your question. The premium on bonds payable account is shown on the balance sheet as a. This Question has Been Answered.

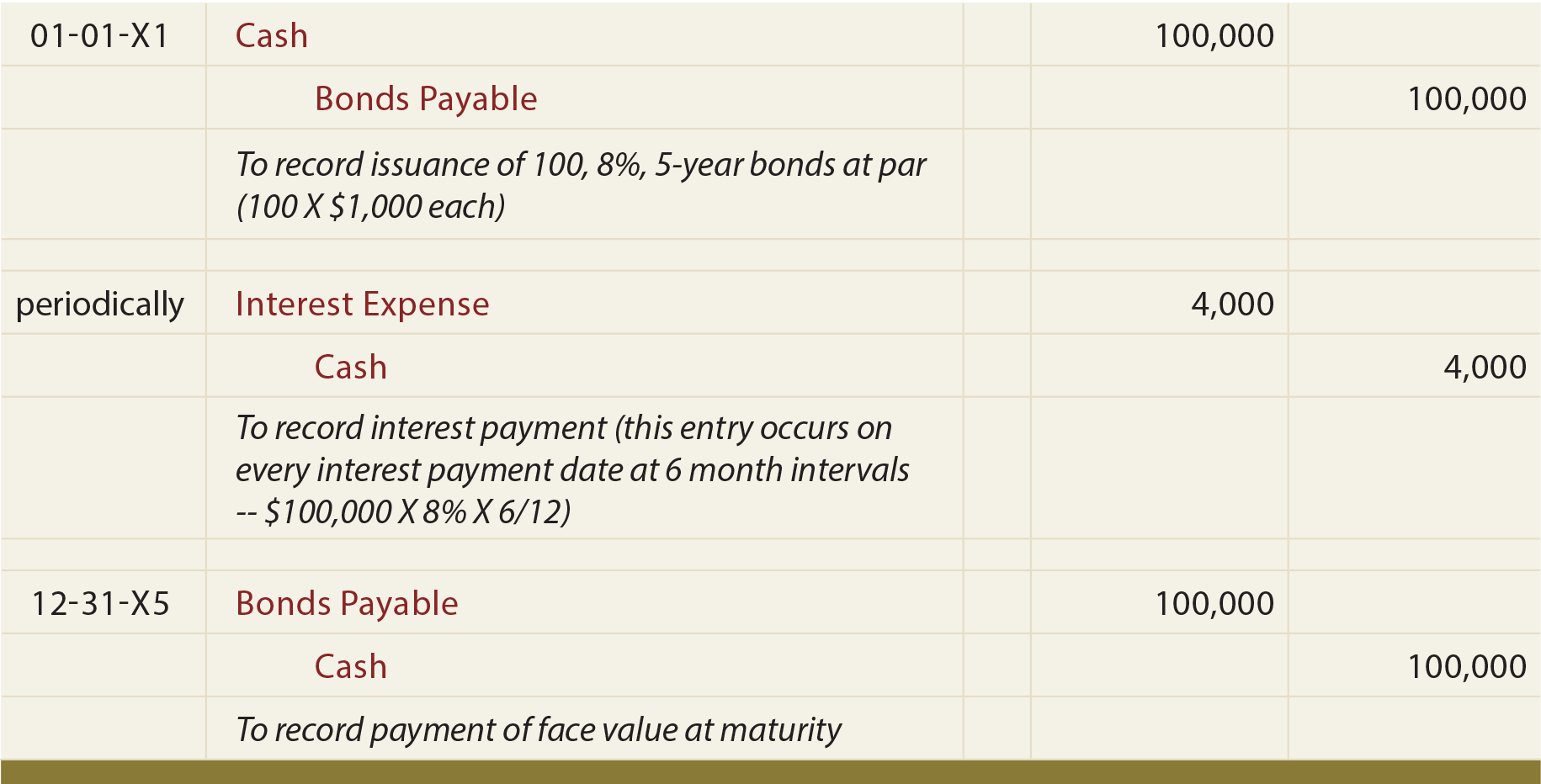

Journalize the bond issuance. A bonus paid by the bondholders to the issuing corporation because of the unusually high interest rate stated in the bonds. Websters entry at June 30 2016 to record the first semiannual payment of interest and amortization of discount on the bonds includes a.

If the market rate is less than the contract rate the bonds will sell for more than their face value. A 10-year bond with a 9 annual coupon has a yield to maturity of 8. A liability in the year the bonds are sold.

Discount on Bonds Payable. Debit to Bond Interest Expense of 30000. The difference between Debit and Credit side of the 03 entries described above 2205000 - 2100000 - 47250 152250 will be recorded as Debit to Loss on bond redemption account.

If an amount box does not require an entry leave it blank. This is the case because investors paid less than the face value of the bonds so the effective interest rate to the company is higher than 8. Additional interest expense the year the bonds are sold.

The current market rate was 75. Which of the following statements best describes bonds. The following table illustrates the effective interest rate method of amortizing the 3851 discount on bonds payable.

Journalize the first interest payment and. Authorized bonds payable discount in effect a loss to the issuing entity. Premium on Discount on.

View Notes - Discount on Bonds Payable from ACCT ac 201 at Montgomery College. The present value of the future interest payments of bond interest and principal d. What best describes the discount on bonds payable account.

A credit to Bond Interest Payable of 30000. What best describes the discount on bonds payable account. The root cause of the bond discount is the bonds have a stated interest rate which is lower than the market interest rate for similar bonds.

Discount on bonds payable or bond discount occurs when a corporation issues bonds and receives less than the bonds face or maturity amount. The December 31 2021 balance sheet of Metlock Co. The bond is selling at a discount.

Began operations on January 2 2017. 136Refer to the information above. Unissued bonds payable cr.

Premium Amortization On the first day of the fiscal year a company issues a 1400000 8 8-year bond that pays semiannual interest of 56000 1400000 x 8 ½ receiving cash of 1484659. Discount on bond payable is computed as follows. A discount on bonds payable is best described as.

Discount Face value - Issue price 750000 - 706565. Discount on bonds payable. The carrying value is found through the following formula.

The face amount of the bonds less the selling price is called a discount. A bond sells at a discount because buyers are not willing to pay the full face amount for bonds with a contract rate that is lower than the market rate. An element of future interest expense.

An amount below par. If the bonds had NOT been convertible they would have sold for 961. Included the following items.

Bonds Payable Bonds Payable. The bonds mature January 1 2030 and the company uses the effective interest method to amortize bond discounts or premiums. It also refers to those bonds whose coupon rates are less than that of the market interest rate and therefore trades at less than its face value in the secondary market.

The amount is a debit to interest expense since it represents an increase of the stated interest rate of 8 on the bonds. Fixed manufacturing overhead costs are best described as. They receive cash for the fair value of the bond and the positive negative difference if any is recorded as a premium discount on bonds payable.

The bonds pay cash interest semiannually each July 1 and January 1 and were issued to yield 6. A reduction in interest expense over the life of the bonds. Prepare journal entries on the following dates.

The bond discount is amortized on a straight-line basis. Unamortized discount on bonds payable. Approach where a journal entry is made to record the authorized bonds payable dr.

The discount on bond payable account is a Contra-Liability account and therefore has a normal debit balance The premium on bond payable account is. The bonds were dated April 1 2020 with interest payable quarterly on July 1 October 1 January 1 and April 1. Using the effective interest method of amortizing bond premium or discount the amount of interest expense for the first semiannual payment was.

The difference between Item 2 and Item 4 is the amount of amortization. The bond is selling below its par value. Deduction from BP in finding carrying amt.

The bonds were issued on December 31 2019 at 95 with interest payable on June 30 and December 31.

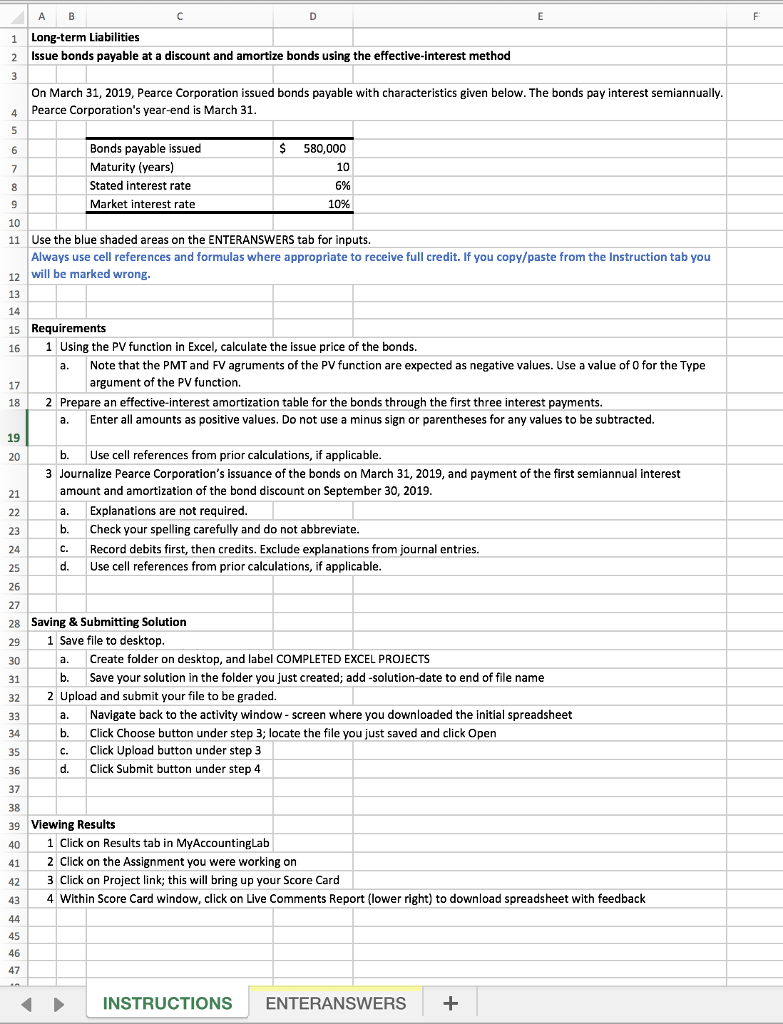

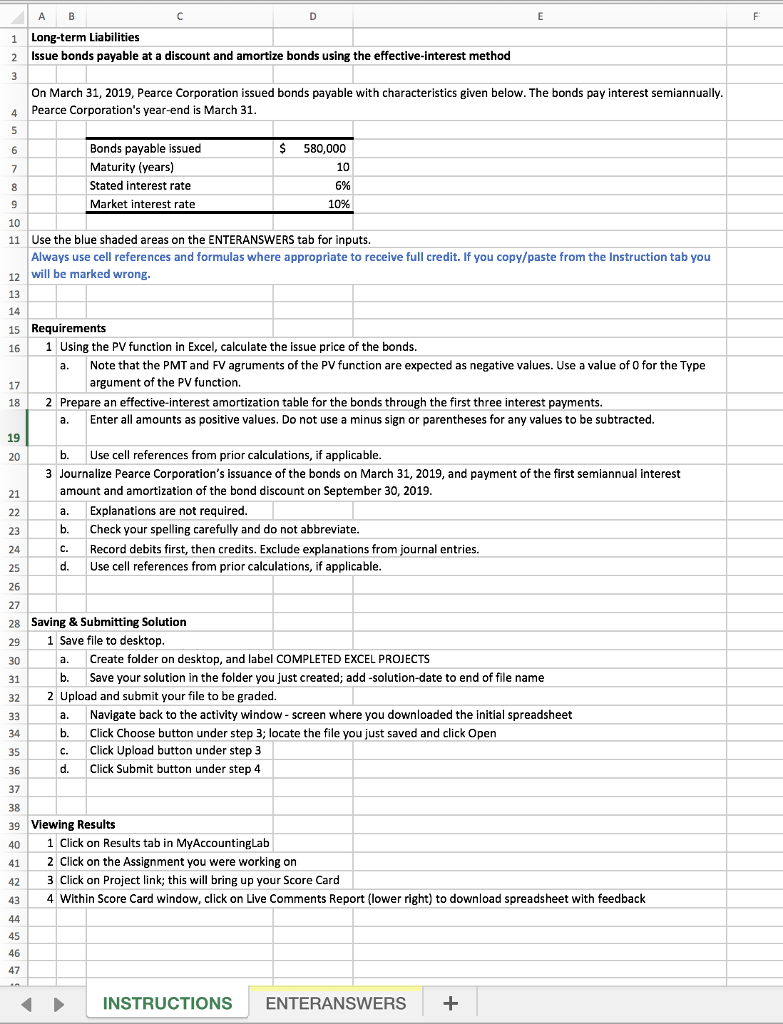

Solved A B Long Term Liabilities Issue Bonds Payable At A Chegg Com

Goodwill Donation Values Spreadsheet Personal Financial Statement Financial Statement Statement Template

Comments

Post a Comment